Ready to buy a home but worried about high interest rates? You might want to consider an adjustable-rate mortgage.

Adjustable-rate mortgages (ARMs) haven’t been much in demand in recent years because rates on predictable, fixed-rate mortgages remained low. They also earned a bad reputation in the financial crisis, when underqualified borrowers lured in by low interest rates were unable to keep up payments when they rose.

However, in today’s housing market characterized by low inventory and high rates, many homebuyers are making the change to adjustable-rate loans that come with lower rates for an initial period of fixed interest. These loans can be a good option for those who are looking to get into a home and take advantage of equity gains but can’t afford a monthly payment at the current fixed rates.

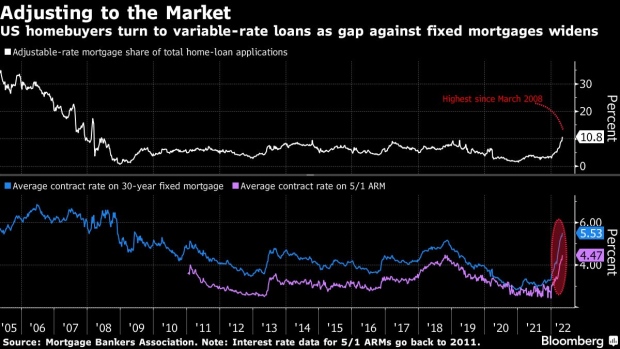

The numbers underscore that fact. According to the Mortgage Banker Association’s Weekly Applications Survey for the week ending June 17, the share of ARMs increased to 10.6% of total applications. That’s up from 3.1% at the start of the year and is the largest share since 2008.

Home loan costs have increased drastically following the Federal Reserve's actions to control the highest rate of inflation in 40 years. According to the MBS report, the average interest rate for a 30-year fixed mortgage rose in June to a nearly 13-year high of 5.53%.

This has made ARMs look very cheap for borrowers trying to lower their monthly payments. These mortgages have a fixed interest rate for a set period (5, 7 or 10 years), after which the rate adjusts annually based on market conditions.

It’s anticipated that rates will drop over the next year as the Fed’s battle against inflation pushes up the risk of recession, which means ARM loans are a great way for buyers to get into the housing market now, take advantage of equity increases, and then refinance to a fixed-rate mortgage once rates go down.

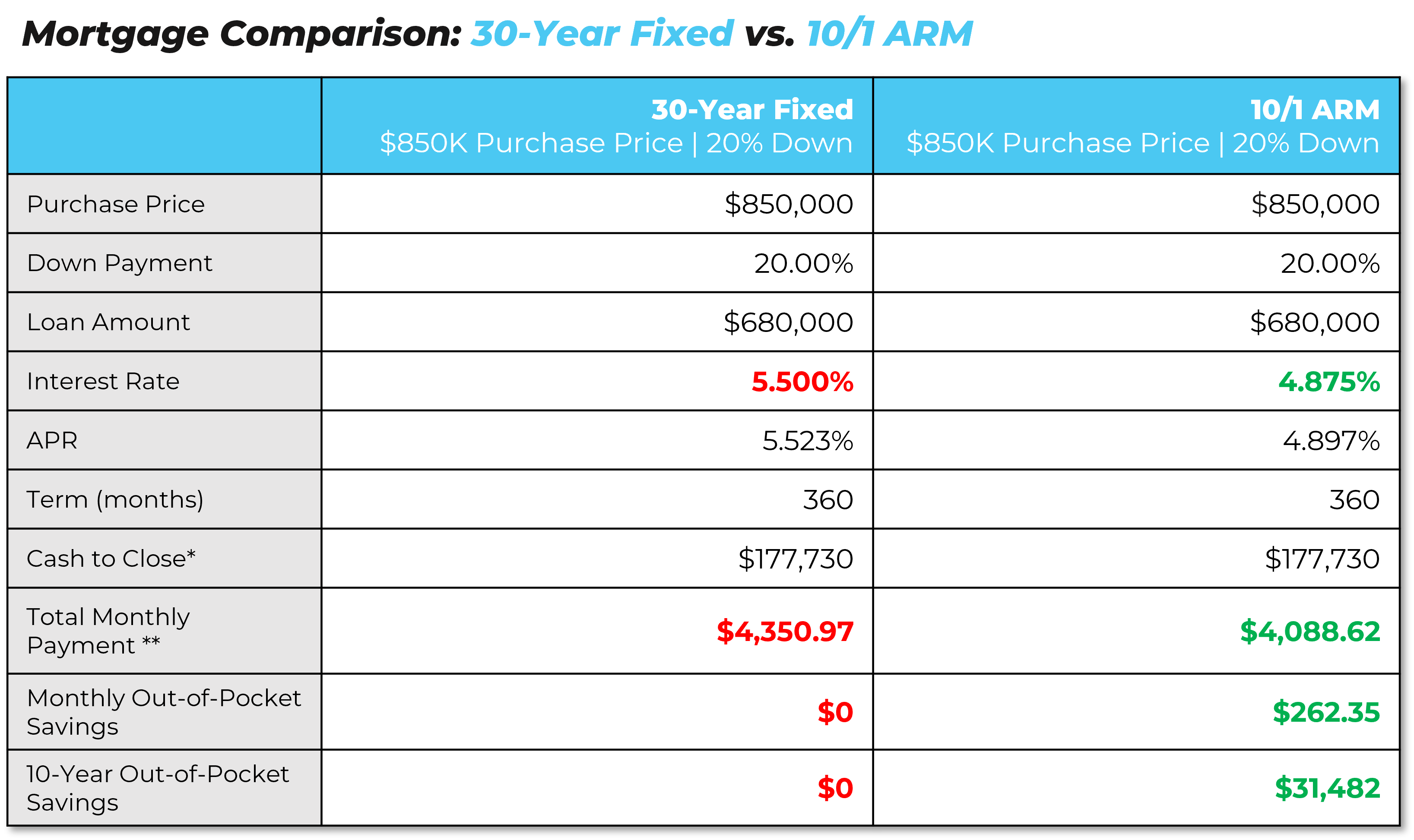

Fixed vs. Adjustable-Rate Loan Comparison

Let’s take a look at just how much you could save with a 10/1 ARM loan today compared to a 30-year fixed loan.

The below scenario is for the purchase of an $850,000 home with a 20% down payment (fixed rate: 5.5%; adjustable rate: 4.875%).

With the decreased interest rate, a 10/1 ARM loan would save you $262 on your monthly mortgage payment compared to a 30-year fixed loan. This would amount to a total savings of $31,482 over the initial 10-year fixed-rate period.

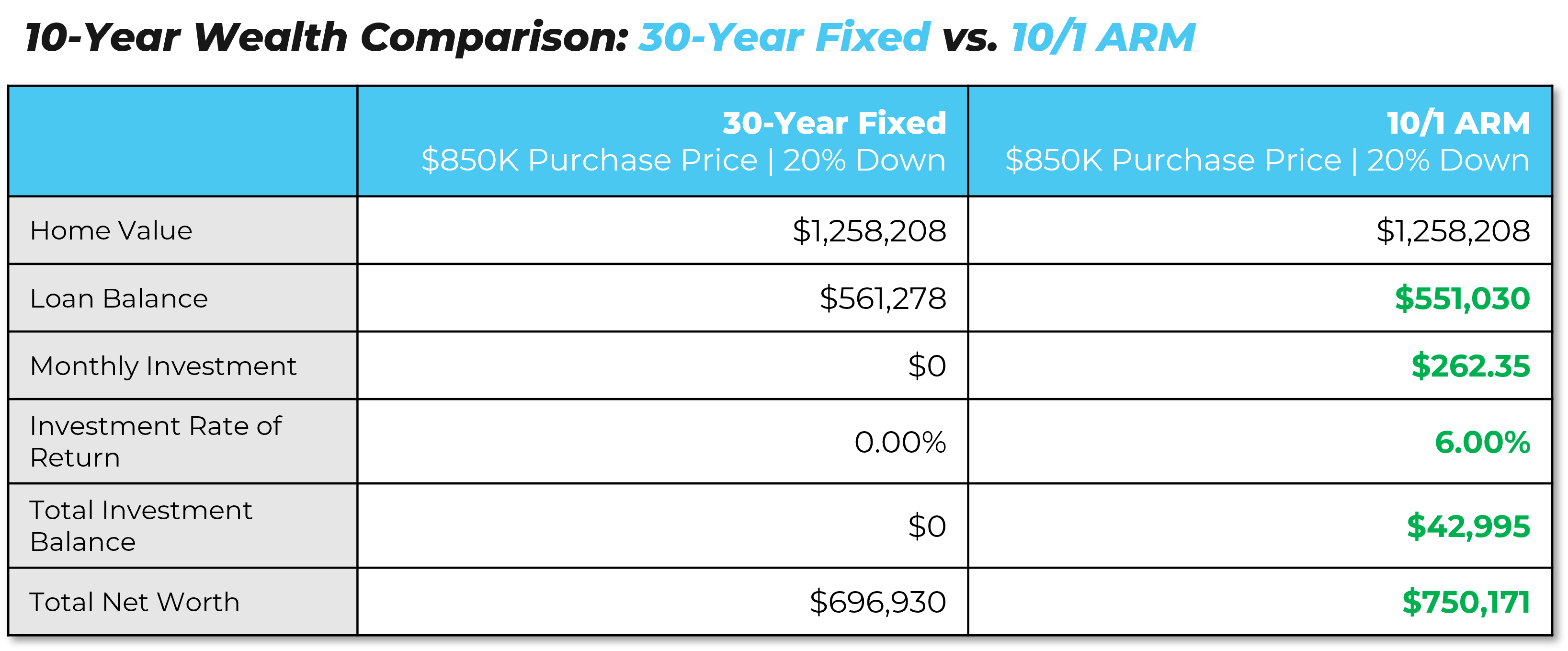

And that’s just the out-of-pocket savings. What if you placed that extra money into an investment account with a 6% rate of return? Here’s how much your net worth would increase by the end of the 10-year fixed-rate period:

If you invested that extra income, you would have a total of investment balance of $42,995 after 10 years.

Taking into account home appreciation (even on the low end at 4% annually), that would put your 10-year net worth at $750,171 just from your home and investment account alone – that’s $53,241 more than you would have with a 30-year fixed mortgage!

The Bottom Line

Homebuyers today have a stronger interest in adjustable-rate mortgages because they provide a solution to the affordability issues caused by higher interest rates. As rates get higher, it might make sense for you to choose an ARM loan over a fixed-rate loan so you can enter into homeownership and start building equity.

Even if you are able to afford both options, an ARM strategy could decrease your monthly expenses in the short term and give you more opportunities to invest and grow your net worth. Rates will not stay high forever, so the opportunity will be ripe for you to take advantage of the immediate savings and then refinance to a lower, fixed rate when the time is right.

Interested in seeing how much you could save with an adjustable-rate mortgage loan today? Let's connect.