If you Google “recession” today, you’ll find thousands of differing opinions from reputable financial and economic news sources about what to expect in the economy.

Some believe that a recession is inevitable, thanks to record-high inflation that curbs consumer spending and halts the economy. Others are of the mind that low unemployment numbers mean the economy will keep chugging along despite higher prices.

The truth is that recessions are part of the economic cycle. Each economic cycle contains a period of growth – called an expansion – and a period of decline, which is labeled a recession. Since World War II there have been several recessionary periods. The last one happened in 2020 following the onset of the pandemic.

But for most people today, the recession that sticks out most in their mind is the Great Recession that followed the housing market crash in 2008. Not only was it recent, but it was the longest recession since the Great Depression and the largest since World War II.

Recessions and the Housing Market

During the Great Recession, home prices in most parts of the U.S. plunged and unemployment surged. Many existing homeowners found themselves underwater on their mortgages and facing foreclosure.

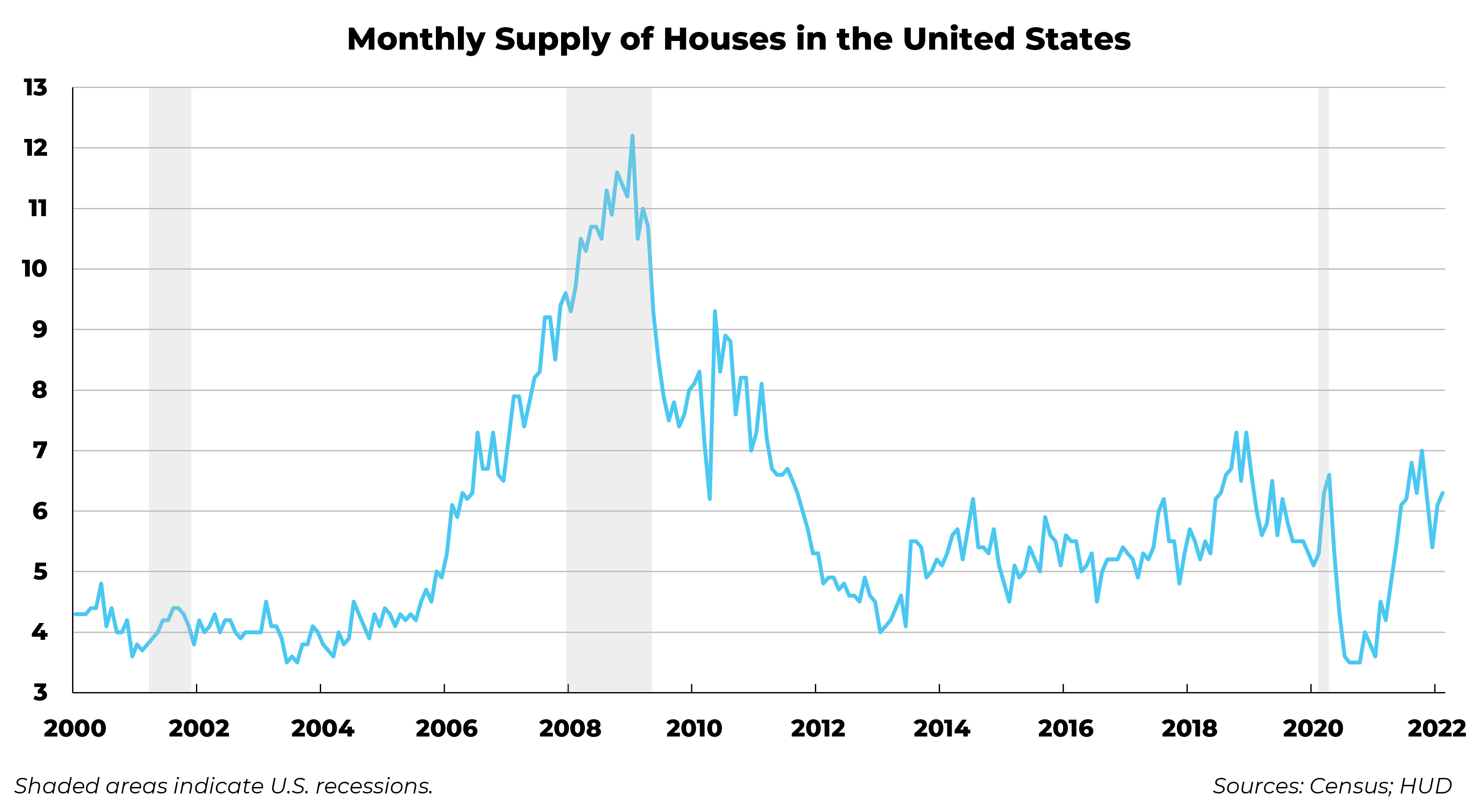

Demand for houses decreased dramatically and supply shot up. Homes were left vacant to be sold by banks, and builders who had been ramping up production to meet the overinflated demand were left with supply they could not sell.

This supply and demand gap led to a free fall in home values. The median sales price for American housing fell almost 20% from 2007-2009.

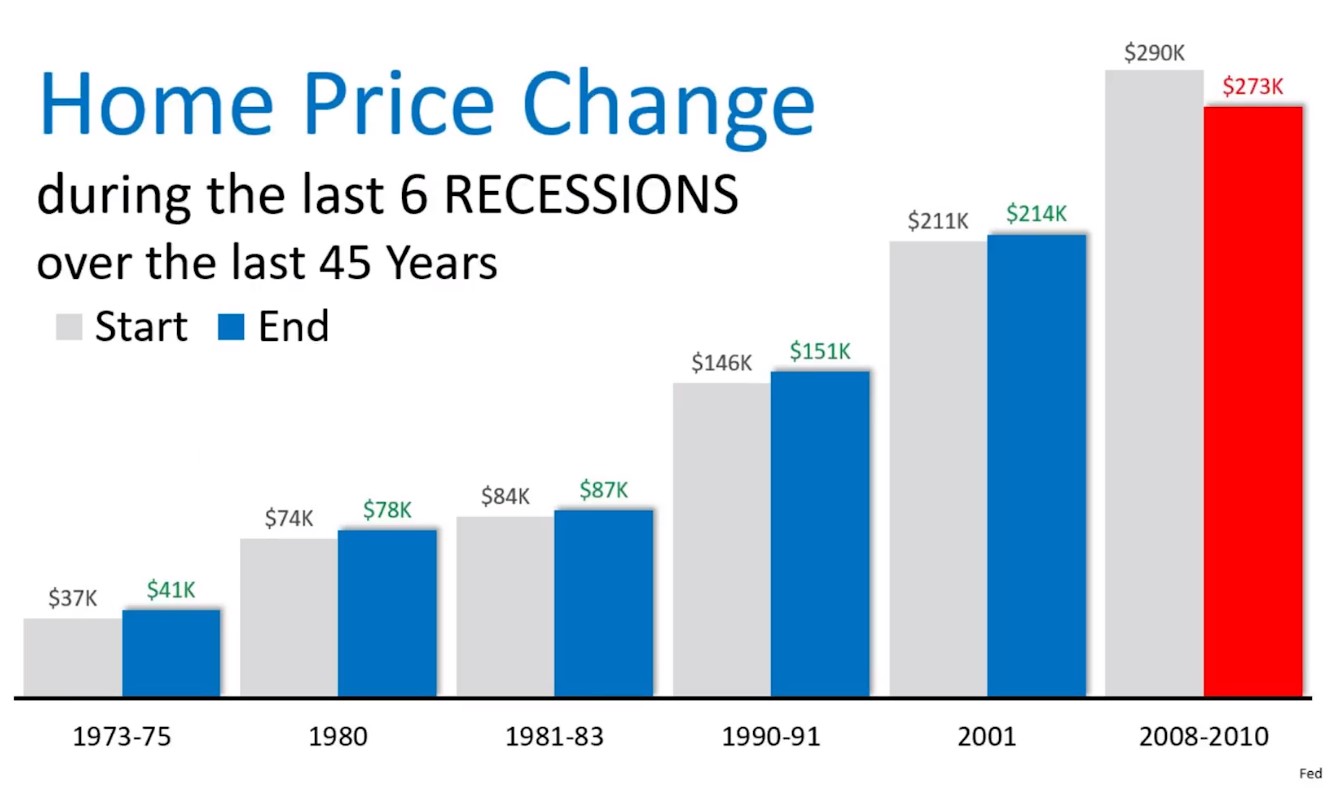

The housing market suffered during this period because the Great Recession was caused by the housing market. However, if you look back at the last six recessions, the Great Recession was the only one that had a negative impact on housing. In fact, housing usually appreciates even more following a recessionary period.

The Current State of Housing

So what’s different this time around?

Prior to the Great Recession, subprime mortgage loans were the norm, and qualifying for a home (and multiple investment properties) was easy to do. This resulted in a speculative buying spree from people who did not have the ability to pay their mortgage payments.

In contrast, today’s homeowners generally utilize their homes as owner-occupied residences instead of investment properties. They also had to qualify for their mortgage loans under stricter credit, income, and down payment requirements.

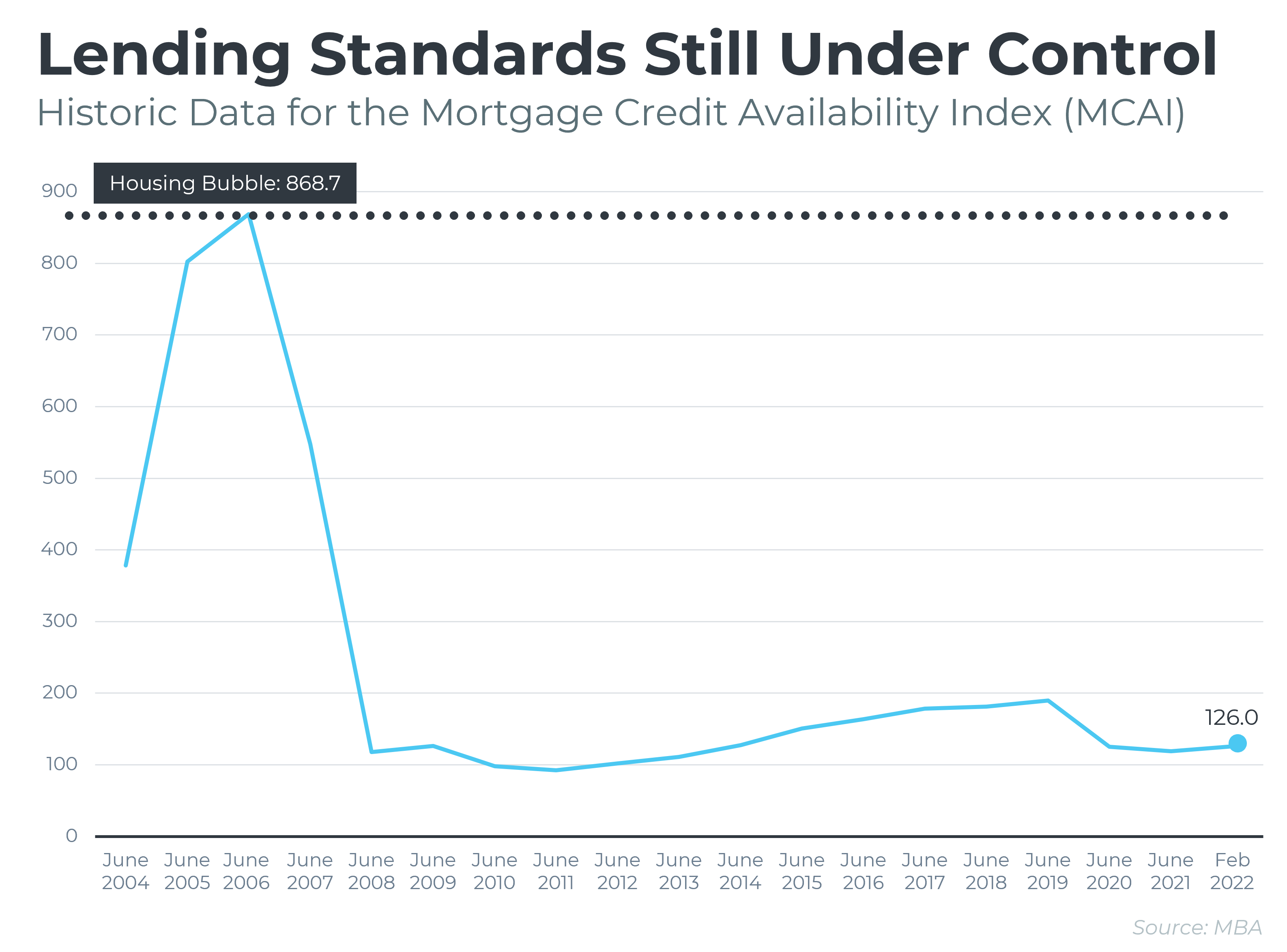

Strict Lending Standards

We can see this tightening of lending standards represented in the Mortgage Credit Availability Index. The higher the index, the easier it is to obtain a mortgage loan. The index hit an all-time high in 2007, and in the fourteen years since the credit bubble deflated in 2008, it has become much more difficult for mortgage applicants to obtain credit approval.

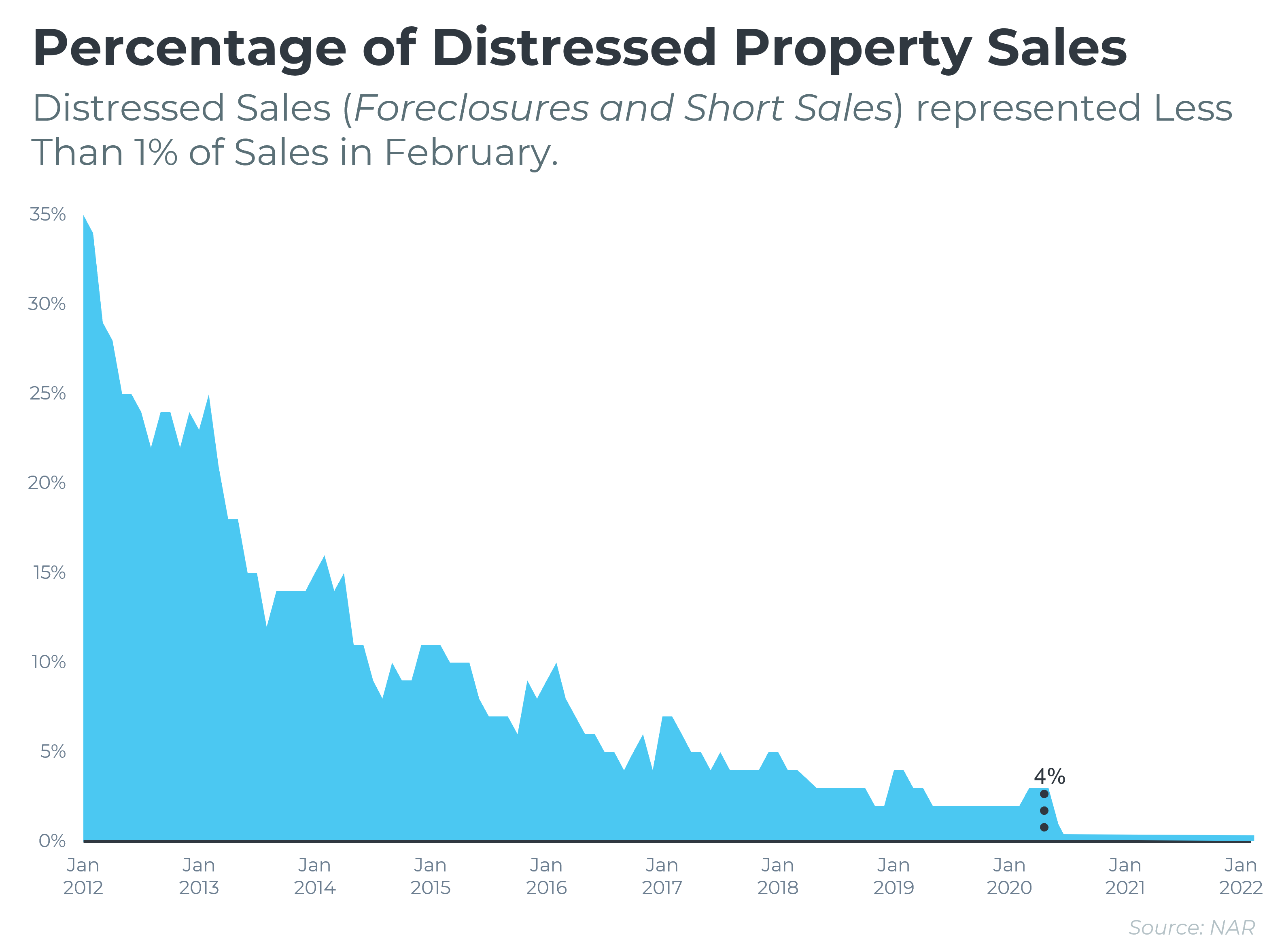

As a result of the more stringent mortgage underwriting guidelines, distressed property sales (properties that are under foreclosure or being sold by a lender) have plummeted to near record lows.

Supply and Demand Are The Complete Opposite

There was a glut of housing inventory prior to the Great Recession. At the same time, construction was booming. That extra supply, plus the wave of foreclosure properties added to it, led to falling prices.

This time around, supply is on the opposite end of the spectrum. The number of listings across the country is minimal. Couple this with strong buyer demand, and that might be enough to prop prices up, even during a recession.

Conclusion

Market conditions are not the same as in 2008, which is the biggest indicator that we will not see a crash like the one a decade ago. Home prices are projected to appreciate for the next few years thanks to the overwhelming demand, meaning real estate will continue to be a safe and lucrative investment.

If you would like help finding a home or getting pre-approved for a mortgage, let's connect.