Can a seller-paid rate buydown really save BOTH buyers and sellers more money than a price reduction?

Home inventory is on the move up, which is completely normal for this time of year. And as more homes come on the market, we are actually seeing a slight transition from an aggressive seller’s market to a market where buyers have a bit more leverage. We are starting to see seller concessions and even price reductions now.

Seller-Paid Rate Buydown vs. Price Reduction

In order to maximize the purchase price for the seller AND keep the buyer’s monthly payment and cash to close as low as possible, we have found that using seller concessions to reduce the buyer’s interest rate (and possibly eliminate private mortgage insurance) is drastically more effective than simply reducing the purchase price.

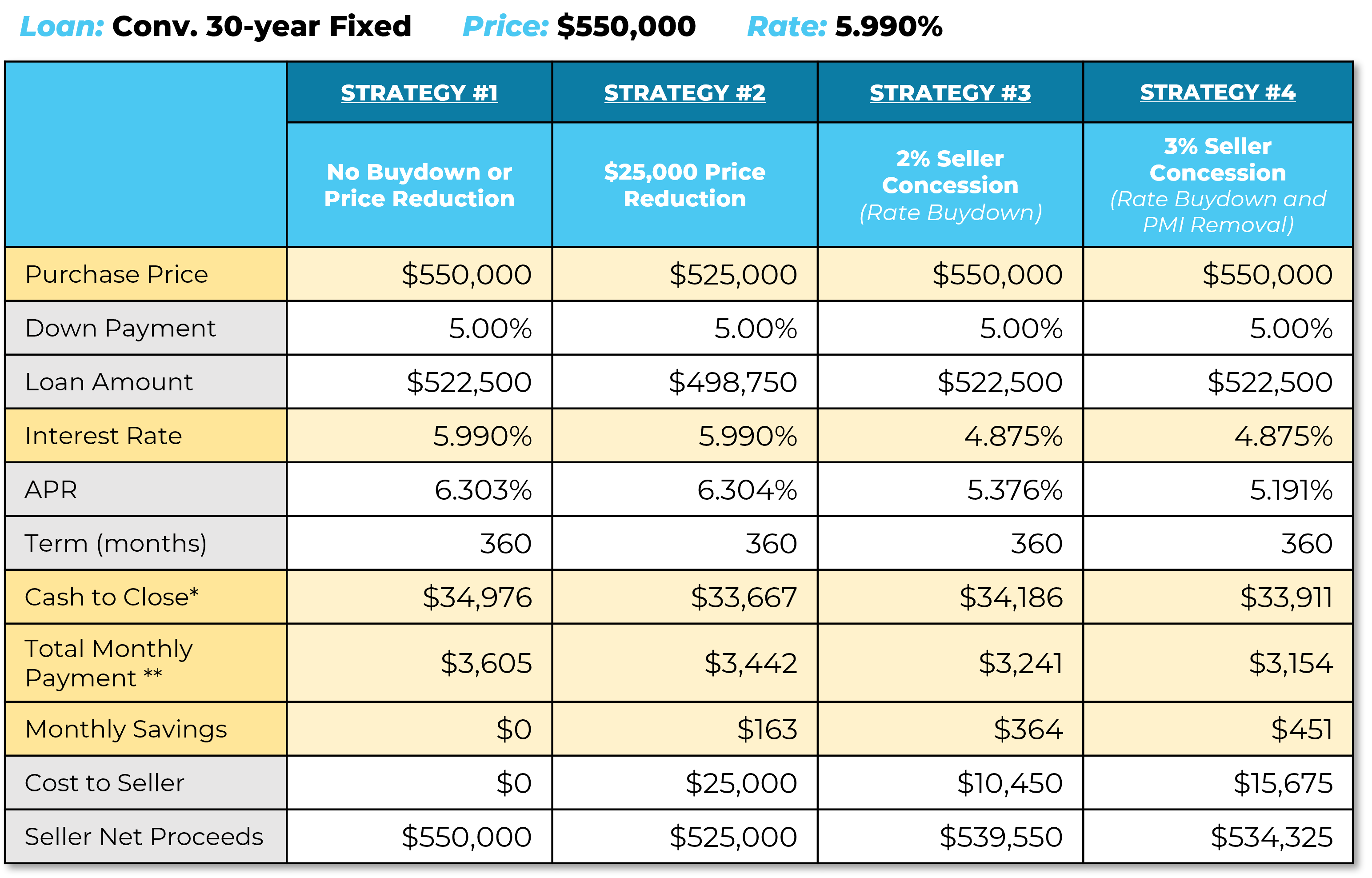

Let’s take a look at a sample Total Cost Analysis comparing the cost and savings from four different financing strategies. This comparison is for the purchase of a $550,000 home with 5% down using a 30-year fixed-rate loan.

Strategy #1: No Buydown or Price Reduction

This shows what the purchase would look like if no points were paid to buy down the interest rate and the home was purchased at the list price – essentially a par rate with no seller concessions.

- Interest Rate: 5.990%

- Monthly Payment: $3,605

- Cash to Close: $34,976

- Buyer Monthly Savings: $0

- Cost to Seller: $0

Strategy #2: $25,000 Price Reduction

This strategy shows what would happen if the buyer and seller negotiated a price reduction of $25,000. This strategy would save the buyer $163 on their monthly payment – but it’s not so much a win for the seller, as they will net quite a bit less from the sale.

- Interest Rate: 5.990%

- Monthly Payment: $3,442

- Cash to Close: $33,667

- Buyer Monthly Savings: $163

- Cost to Seller: $25,000

Scenario #3: 2% Seller Concession (Rate Buydown)

Strategy #3 shows a better way for the offer to be structured to save both the buyer AND seller money, rather than just taking dollars off the top by reducing the price. This is the Seller-Paid Rate buydown strategy, where the seller pays 2% of the loan amount to reduce the buyer’s interest rate on their mortgage. This strategy reduces the interest rate by more than 1%, brings the cash to close down similar to the price reduction strategy, and reduces the buyer’s monthly payment by $364 – more than double the savings of the price reduction strategy!

As for the cost to the seller? Only $10,450 – less than half the cost would be if the price were reduced by $25,000.

- Interest Rate: 4.875%

- Monthly Payment: $3,241

- Cash to Close: $34,186

- Buyer Monthly Savings: $364

- Cost to Seller: $10,450

Strategy #4: 3% Seller Concession (Rate Buydown and PMI Removal)

What would happen if the maximum seller concession of 3% was applied? This strategy could not only reduce the interest rate but also eliminate mortgage insurance for the life of the buyer’s loan, bringing the monthly savings to nearly triple the amount associated with the price reduction strategy.

- Interest Rate: 4.875%

- Monthly Payment: $3,154

- Cash to Close: $33,911

- Buyer Monthly Savings: $451

- Cost to Seller: $15,675

The Bottom Line

As you can see, when it comes to price and concessions negotiations, a seller-paid rate buydown strategy is much more effective at saving both parties money than a simple price reduction. The buyer gets a much lower monthly payment and has to bring less cash into closing, and the seller gets to maximize their profit by keeping the home at the list price.

If you would like to learn more about the benefits of a seller-paid rate buydown strategy, or if you would like to see a loan comparison similar to the one above for your particular purchase scenario, please connect with us. We would love to help!