In March 2020, at the start of the COVID-19 pandemic, millions of Americans were either laid off or furloughed from work. Unemployment skyrocketed and Congress launched a series of programs allowing Americans to enter into mortgage forbearance and pause their mortgage payments for up to 18 months.

A majority of these 18-month windows have been coming to a close over the last year, which has led some to speculate that a home foreclosure crisis is imminent. But what do the numbers really say?

YES, Foreclosures Are Increasing

Black Knight Inc. recently released a first look at its Mortgage Monitor Report for June 2022, which looks at delinquency and foreclosure rates across the U.S. According to the report, foreclosure starts were up 26.6% in June on a monthly basis and up 440.91% year-over-year.

Foreclosures are increasing so drastically because mortgage forbearance is ending for an increasing number of Americans. The moratorium on foreclosures thanks to the CARES Act has been in place since March 2020, and nearly 8 million borrowers have taken advantage of the program since its inception according to Black Knight.

As more and more borrowers exit their forbearance periods, it makes sense that foreclosure activity has started to increase. The final date for homeowners to enter into mortgage forbearance was September 30, 2021, so you can expect to see higher-than-average foreclosure activity for another year or so as the final 18-month forbearance periods come to an end.

No, We Are Not Heading For A Foreclosure Crisis

The last foreclosure crisis was the period of drastically elevated property seizures in the U.S. housing market between 2007 and 2010. This crisis was primarily fueled by a dramatic expansion in mortgage lending consisting mainly of subprime, adjustable-rate loans to borrowers who were unable to make their mortgage payments once economic conditions worsened and their interest rates increased.

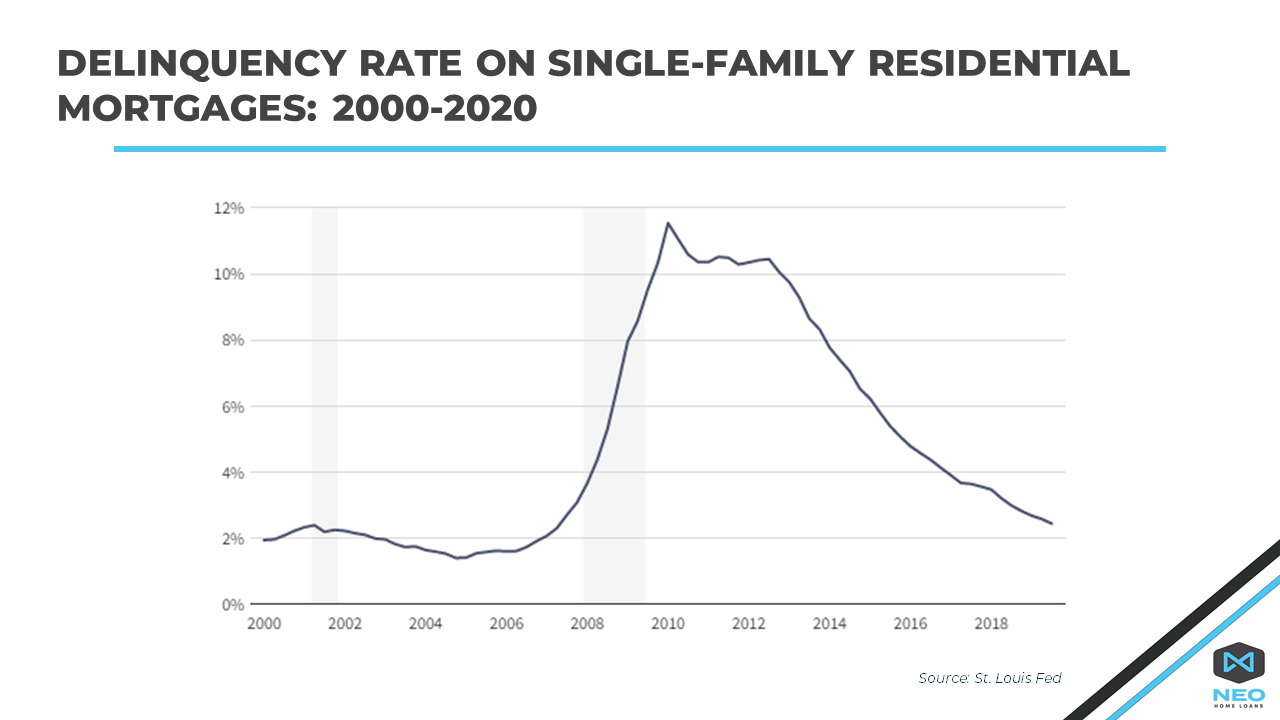

This resulted in the delinquency rate of single-family residential mortgages increasing from 2.08% at the start of 2007 to 11.54% at the start of 2010.

As current foreclosure activity begins to increase, many are fearful that we may be facing another crisis like we saw during the last housing crash, when a large amount of foreclosed homes flooded the market and resulted in a drastic increase in housing supply and a freefall of home values – but that is not going to happen!

There are three main reasons why you should not be worried about a foreclosure crisis:

1. Equity

Payment affordability was not the only factor that drove the last foreclosure crisis; it was also the lack of equity. Borrowers did not want to make payments against an upside-down asset.

According to Black Knight, as of April 2022, U.S. homeowners had a collective $11 trillion in home equity. That’s twice the previous peak in 2006 and works out to an average of $207,000 in equity per homeowner. This means that homeowners today have plenty of cushion to fall back on if they cannot make their mortgage payments.

2. Stricter Lending Standards

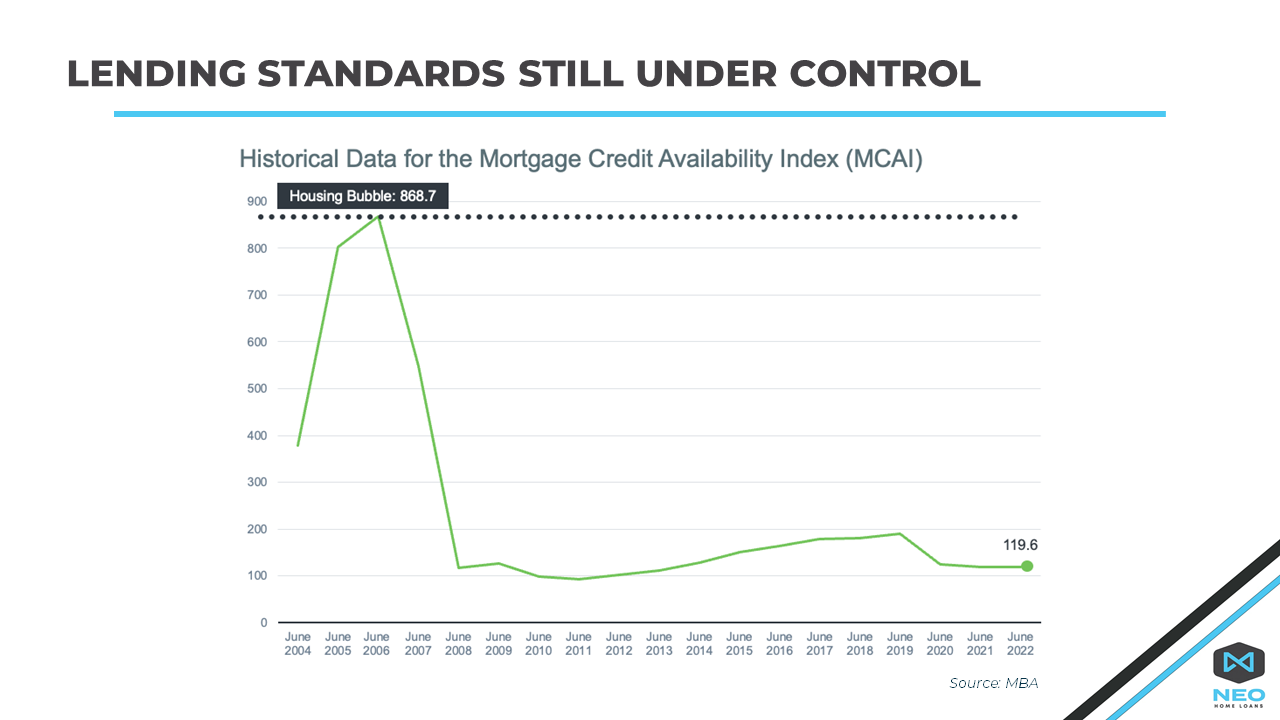

Leading up to the housing market crash, subprime mortgage loans were the norm, and qualifying for a home (and multiple investment properties) was easy to do. This resulted in a buying spree from people who did not have the ability to pay their mortgage payments.

Lending standards have tightened drastically since then, which you can see represented in the Mortgage Credit Availability Index. The higher the index, the easier it is to obtain a mortgage loan. The index hit an all-time high in 2007, and in the fourteen years since the credit bubble deflated in 2008, it has become much more difficult for mortgage applicants to obtain credit approval.

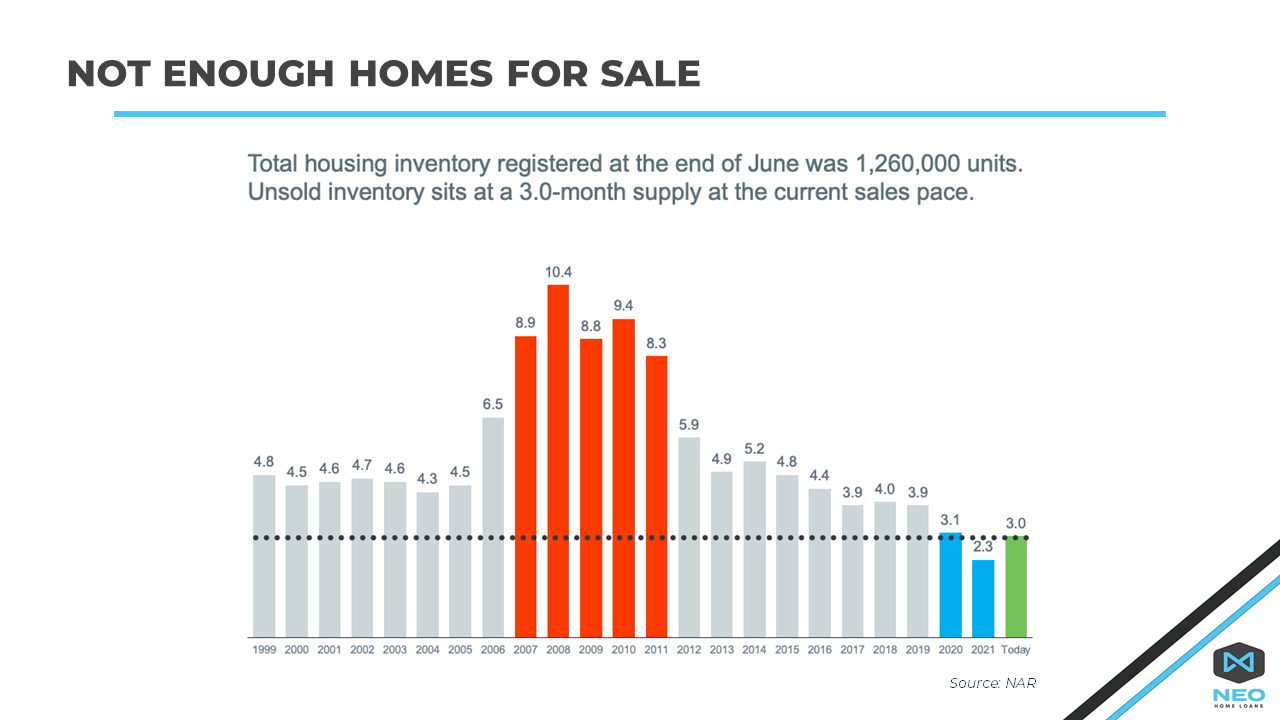

3. Supply and Demand Are The Complete Opposite

There was a glut of housing inventory prior to the housing market crash. At the same time, construction was booming. That extra supply, plus the wave of foreclosure properties added to it, led to falling prices.

This time around, supply is on the opposite end of the spectrum. The number of listings across the country is increasing but is still not enough to meet the demand. This means that the market is capable of absorbing the small increase in distressed properties without home values dropping.

The Bottom Line

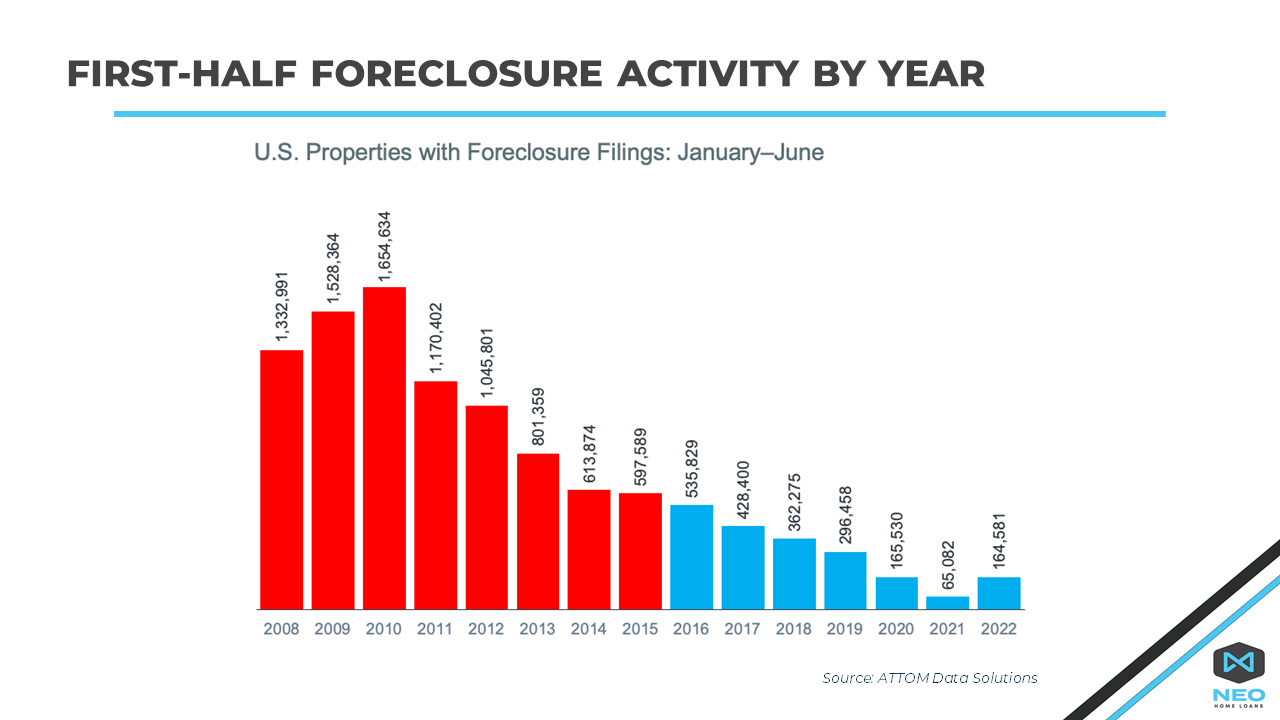

Only 0.3% of all homes are in foreclosure right now – up from an all-time low of 0.2% – and the foreclosure activity in the first half of 2022 was 1/10 of what it was at the beginning of 2010.

The below chart from ATTOM Data showing first-half foreclosure activity by year says all we need to know: we are not even close to a foreclosure crisis.

Yes, foreclosure activity has increased and will continue to do so as more homeowners exit their forbearance plans and face the reality of making mortgage payments for the first time in over a year, but these numbers are nothing to be afraid of – they are just a return to normal, pre-pandemic levels.

Additionally, the combination of high homeowner equity, stricter lending practices, and the large gap between housing supply and demand means the market is completely capable of handling the increase of distressed properties.

What does all this mean? Do your research and don’t only listen to what you hear in the news! When it comes to your homebuying decisions, it’s important to have a trusted mortgage advisor in your corner – one who can help you cut through the noise and guide you to making smart financial decisions.

We would love to advise you on your homebuying journey. Let's connect!