As rising interest rates and inflation are decreasing the demand for homes, fears of a coming recession are on the rise. Prospective buyers may be wondering what it all means for their dreams of owning a home.

We know how economic slowdowns have impacted home prices in the past, but how could this next slowdown affect real estate values and the cost of financing a home?

The truth is we have been enjoying an out of control economy. Americans have been making more than ever, credit scores are higher than ever, and homeowners have more home equity than ever. We are also seeing the highest percentage of home ownership and (until recently) housing affordability than we’ve ever seen before.

Is there bound to be some sort of economic correction? Yes. Recessions are a cyclical part of the economy and can be expected. The housing market will be affected just like every other asset class, but not as drastically and catastrophically as many media outlets would lead you to believe.

Let’s explore why.

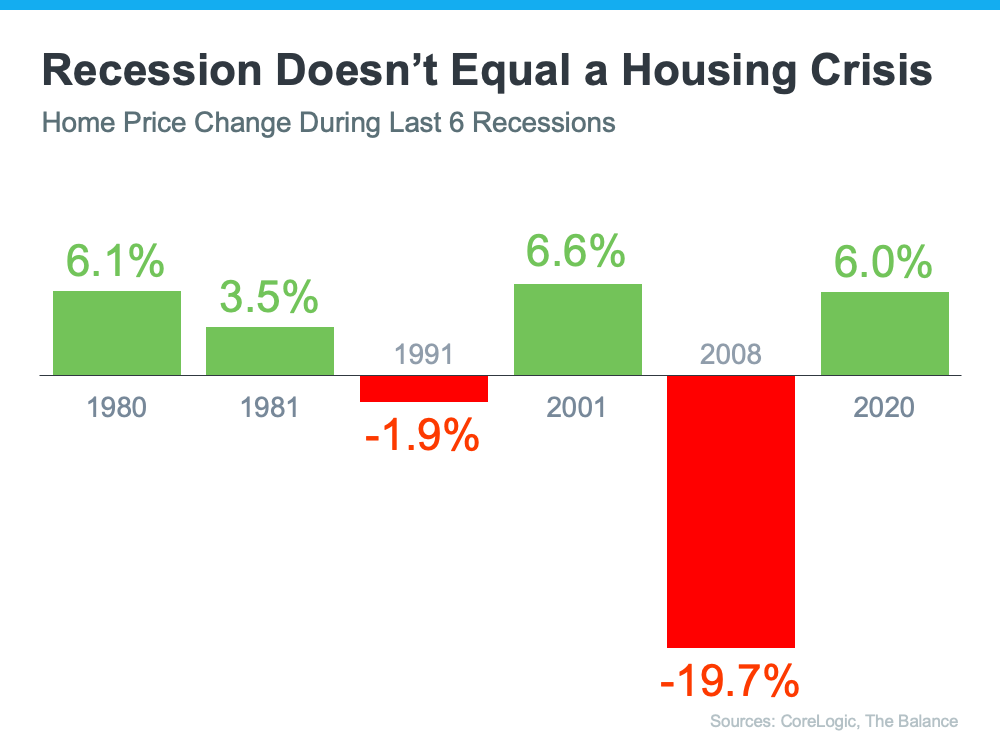

History of Home Prices During Recessions

We’ve had plenty of recessions that we can look to for clues on what to expect for this recession:

During the recession in 1980, which is a similar recession to the one we are going through right now (high inflation, high interest rates, etc.), but home prices continued to rise at a good rate. Interest rates went up to 17% during this time, which is nothing like we are seeing now. The economy was very healthy back then, just like it is today.

The 1991 recession saw housing prices drop slightly for about a year.

In 2001, 9/11 created a big recession. That’s how interest rates got down and prices went up. After 9/11 occurred, our economic market competely shut down.

2008 was the only time we saw housing prices drop significantly, but that situation was very different. The decline in home prices actually caused this recession — not the other way around. Too much housing supply and not enough demand led to home prices tanking, and a recession followed.

Finally, in 2020, the Covid-19 pandemic brought on another recession. This one was so bad that the government started to print money. Housing prices started to creep up while everyone was sheltering in place, and they continued to rise nearly 16% over the whole year. In 2021, housing prices went up another 20%.

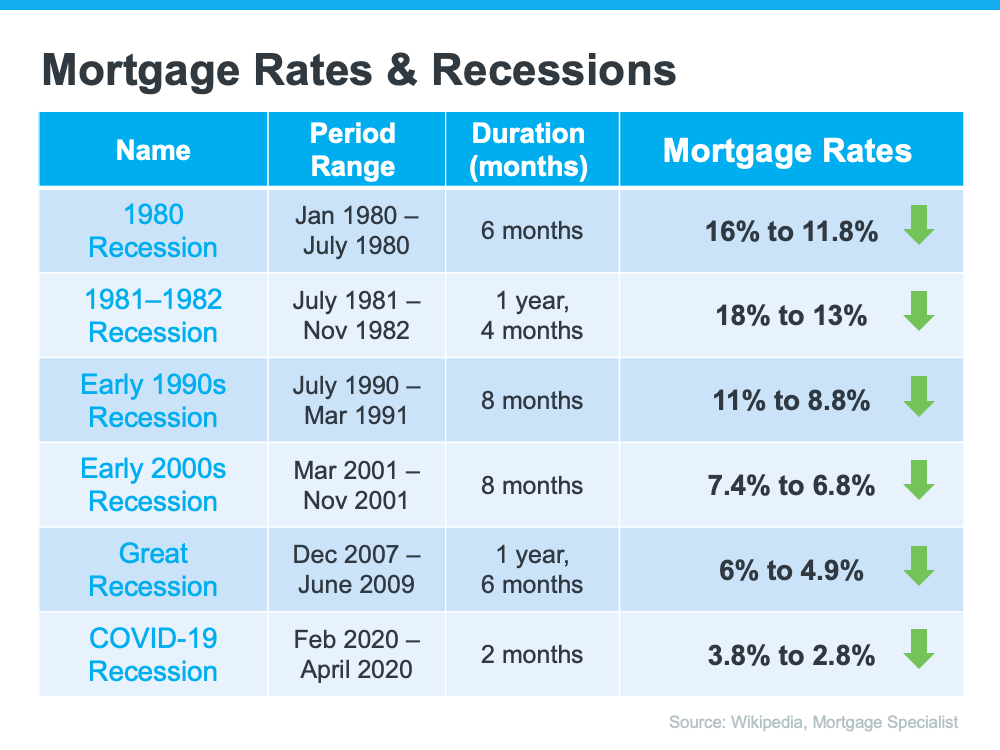

History of Mortgage Rates During Recessions

Historically, interest rates have gone up in the months leading up to a recession. But in order to come out of a recession, interest rates are lowered to stimulate the economy moving forward.

Here’s the data to back that up. Here’s what happened to mortgage rates in each recession going back to 1980:

As the chart shows, historically, each time the economy slowed down, mortgage rates decreased. Fortune.com helps explain the trend like this:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

While an economic slowdown needs to happen to help taper inflation, it hasn’t always been a bad thing for the housing market. Typically, it has meant that the cost to finance a home has gone down, and that’s a good thing.

What to Expect During The Next Recession

Will the housing market start to cool down as we enter a recession? Yes. This is only be expected as inflation and high interest rates make affording a home difficult for many Americans.

However, a slowing market does not mean a crashing one! Housing supply is still very low and demand is still very high. Until the supply problem is fixed, home prices will remain steady. Affordability constraints mean demand will dip slightly, but once we enter a recession and interest rates fall, demand will start to rise again.

Home prices are projected to appreciate for the next few years thanks to the overwhelming demand, meaning real estate will continue to be a safe and lucrative investment. If you would like help finding a home or getting pre-approved for a mortgage, let's connect.